Are You Drowning or Climbing Out?

During the last 23 years of my consulting work, there have been times when my life has seemed like a cross between two of my favorite movies, Catch Me If You Can and Up In The Air. Here’s a quote from the Actor Christopher Walken in Catch Me If You Can that I believe you will find appropriate for our discussion that follows:

- “Two little mice fell in a bucket of cream. The first mouse quickly gave up and drowned. The second mouse, wouldn’t quit. He struggled so hard that eventually he churned that cream into butter and crawled out. Gentlemen, as of this moment, I am that second mouse.”

My question for you is this: As you face industry challenges or ones that are specific to your operation, which one are you?

I’ve been called crazy for doing some of the work that I’ve completed these past 23 years, but you know what? I love doing this work. Is it challenging and occasionally frustrating? Yes. Can it be difficult at times? Yes, but if it was easy, everyone would be doing it and take all of the profit out of the process.

How do I do this? I recently reviewed my records and discovered that I’ve completed 73 financial turnarounds with Clients since 1999. That’s a lot of change! Some of these rescue missions have taken 1-2 years; others have taken 5 years or more. Some of them, following their financial recovery, decided it was time to exit their industry. The great thing on these was that they were positioned to sell out and walk away with sufficient proceeds to live the rest of their lives successfully. That news helps me to sleep at night.

So where are you in your current operation? Many industries, especially on dairies today, are facing some dire outlooks, but it doesn’t have to be that way. As the saying goes, “The best time to plant an oak tree was 20 years ago.” However, the next best time is today.

Here are some thoughts for you as you think about this question of what should happen next:

- Begin with what I call the Discovery Process. Where do you want to go and Why? If you can answer these two questions, step #2 is easier.

- Complete an analysis of where you are today, in terms of assets, debts and overall cash flows. This information provides the building blocks for your success plan.

- Outline and discuss the challenges that you will face in your next steps. My next blog will be focusing on just that topic.

- Evaluate what Cash Flows will be required to make it all happen successfully.

- Talk to your banker. Please don’t tell me this is too tough… I’ve faced off with large banks where the Client owed $6 million and had almost no collateral. What could we do? We simply built a repayment plan and worked through it successfully. The one thing I knew going in was that there was a solution. They just hadn’t identified it. If they had, my input wouldn’t have been needed. My saying that I was sure there was a solution may sound arrogant to you, but trust me. After you’ve completed 73 of these turnarounds, you start to understand that the answer, indeed, is out there. We just have to dig it up!

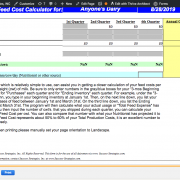

- Once you determine your plan of action, track your Cash Flows and always know where you are throughout the year. I treat CF Analysis the same as MacDonald’s founder Ray Kroc did the hamburger. Recall what he said? “I didn’t invent the hamburger. I just took it more seriously than anyone else.” It’s the same for me with Cash Flow Analysis!

Once again, are you drowning or climbing out of the bucket of cream? If I can assist you, please let me know. I’m happy to help.

Let’s take your business to the Next Level!

Leave a Reply

Want to join the discussion?Feel free to contribute!