Are You Playing by the Rules?

I recently reread Tim Ferriss’ first book entitled The 4-Hour Workweek and noted a special recommendation that he made. It was based upon an old Chinese Proverb, which advised us to always know what we are getting involved in ahead of time and went something like this:

- Always know the Rules of the Game.

- Know the Prize for which you are competing.

- Know when the Game Ends.

As I read those words, I started thinking about how they also apply to business dealings.

For example, before you enter any loan agreement with your bank or another institution, it’s critical that you know what the “Rules of the Game” are. What is expected of you in maintaining a satisfactory loan relationship? What are the loan covenants? What can happen if you don’t fulfill all of the covenants? Is there a reasonable remedy that you can provide if this occurs? I would expect that after last year’s challenging financial results, there will undoubtedly be some covenant violations…

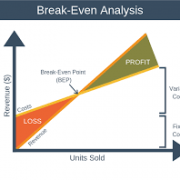

Knowing what the prize is at the end of the “game” can be helpful, especially if you are being faced with profitability and covenant challenges. Sometimes, borrowers can let their pride get ahead of the potential prize at the end of the game. Often, this can lead to getting over-extended on loans in terms of Debt Service Coverage. Hence, the need for accurate Cash Flow projections & ongoing measurement (https://success-strategies.com/).

Finally, know when the game ends. When has your objective been reached? Perhaps, more importantly, know when enough is enough… Obviously, the game ends when you pay the loan off in full, but what happens if you run into problems before the loan is paid in full? Will your banker work with you to resolve the challenge you are facing? This is always good to know ahead of time, because, as some borrowers are facing today, their bank’s workout group has become more of a “kick-out group.” While it is admirable to get refinanced elsewhere, the current lender does not need to make it a painful process or one lacking support.

On the contrary, let’s put strategies in place to assist the borrower to make the necessary changes, possibly sell some assets and get themselves back on track financially. This is never an easy process and as George Bernad Shaw suggests below, it may not even seem reasonable, but it is definitely worth pursuing:

“The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore, all progress depends on the unreasonable man.” George Bernard Shaw

Let’s take your business to the Next Level!

Leave a Reply

Want to join the discussion?Feel free to contribute!